No Bank Account No Problem: The $100B+ Unbanked Market

DeFi, Alternative Credit Scoring, and P2P Lending are revolutionizing finance in emerging markets for the 1.7B unbanked people around the world.

Macro Media Lab is a bi-monthly report that dives into the biggest trends happening in emerging markets.

Subscribe to get the top reports and two deep dives a month.

The Quick Summary

Emerging markets have high rates of internet penetration and high rates of unbanked or underbanked populations, creating a growth environment for fintech companies.

Blockchain networks like Solano, Cordano, and Polkadot are laying the foundation for decentralized finance (DeFi) in Africa and Southeast Asia. The industry is still early but has lots of potential.

Alternative Credit Scoring is enabling the creation of credit scores using mobile data instead of prior banking history. It is quickly being adopted in embedded finance and buy now pay later solutions allowing 1.7B unbanked people to access credit.

What do you mean by unbanked?

While 80%+ of the population in SEA has mobile internet access, a large proportion of them are unbanked. For instance, Cambodia, the country with the highest mobile connectivity in the region, has 95% of its population living without any financial services from the bank. 80% of the population in the Philippines, Indonesia, and Vietnam are also unbanked.

This isn’t limited to South East Asia (SEA). Globally 1.7 Billion adults don't have a bank account. Almost half live in countries like India, China, Nigeria, Indonesia, and Mexico - regions that are witnessing large rates of internet penetration.

This has created is a unique $100B+ challenge that has the potential to change the way we assess and provide people with credit and wealth building services. Digital unsecured lending (lending without physical collateral) is growing at a rate 4x faster than regular lending from banks and is seeing most of its innovation come from South East Asia and Nigeria.

How does an unbanked person usually get money?

These story of Sarita, a part-time maid at multiple houses in a certain neighborhood, is a common examples across emerging markets. With no formal banking history and her children’s fees to pay, Sarita often heads down to a local pawnshop and pledges her jewellery as security for a loan that comes at a staggering interest rate of 30-35%. This are the norm for the billions who are unbanked in emerging markets across the world.

What industries are seeing growth?

Within the unbanked sector there are a few areas that are seeing rapid growth and innovation.

P2P lending: Global P2P Market Growth from $68B in 2019 to $560B in 2027. Lending is the second largest industry in emerging markets fintech after payments. P2P lending focuses on unsecured lending (lending without collateral) for consumers and small businesses - areas that traditional banks don't like to enter due to their risk profile.

Alternative Credit Scoring: This market supports the P2P lending industry by providing alternative ways to measure credit-worthiness from someone without banking history. This industry is new and rapidly growing. Industry leaders are between the Series A and Series C stage across various emerging countries, with larger players getting into lending themselves (list below).

DeFI: While still early, DeFi (decentralized blockchain-based finance) has the biggest potential to disrupt traditional forms of lending and banking. It's adoption and application is strongest in regions that have an unreliable central banking system and high currency volatility. One example is Xend, which provides a way for credit union members in Nigeria to combat currency deflation during their economic crisis. Similar solutions utilizing stablecoins have been implemented in the Phillipines and are on the rise in India.

Who are the rising players

List of Peer to Peer Lending Companies (Emerging Markets)

AntGroup (China)

WeLab (China)

Tala (Kenya)

Jumo (South Africa)

Koinworks (Indonesia)

Amartha (Indonesia)

Investree (Indonesia)

Moneytap (India)

Lendingkart (India)

Capital float (India)

Faircent (India)

Shubh loans (India)

List of Emerging Alternative Credit Scoring Companies (Emerging Markets)

CredoLab (Singapore)

EarlySalary (India)

InCred (India)

Geru (Brazil)

Nubank (Brazil)

Getbucks (South Africa)

Kueski (Mexico)

List of Emerging DeFi projects - Decentralized Finance (Emerging Markets)

Deep Dive: DeFi

DeFi stands for decentralized finance and refers to a revolutionary financial system that is transparent and trustless. It is built on blockchain and consists of smart contracts, dApps, and protocols.

In India and South East Asia, blockchain development is less established than the US or China. Creating space for new players outside of Ethereum, which most DeFi platforms in the west are based on. A prime example is Solana, a web-scale, Layer 1 blockchain capable of handling up to 50,000 transactions per second (TPS). It focuses on speed and low transaction costs, tackling some of the core problems with the Ethereum network and focuses solely on South East Asia - where Ethereum has not yet penetrated well.

In the same way that the Ethereum foundation distributed grants so more platforms and projects in the early DeFi space are built on its network, Solana just launched a $5M fund with Coin98 Ventures for South East Asia. Providing a funnel to create and help scale new DeFi projects that are built on the Solana network.

Other players are Cordana, who is pursuing a number of partnerships with governments in Africa, and Polkadot who has been making strong inroads into the South East Asian ecosystem alongside Solana. The main difference is that unlike Solana, Polkadot was designed to work with the leading smart contracts blockchain protocol rather than compete against it. So regardless of which protocol dominates South East Asia, Polkadot can work with it. It’s already seeing usage in pop-culture. RBW Japan, a subsidiary of the large Korean entertainment company, has started selling NFTs of its K-pop artists products on the Polkadot network. A part of the NFT craze that has been gripping the world over the past few months.

“Who's actually going to do peer-to-peer loans? Who's actually going to do peer-to-peer insurance? Who's actually gonna do peer-to-peer payments? I got news for you, not a guy living in New York”

- Charles Hoskin, Founder of Cordano

While there is a lot of buzz around the DeFi ecosystem in emerging markets, it is still early and will need time to mature. But DeFi provides the perfect alternative to the broken financial systems that exist in emerging markets.

Deep Dive: Alternative Credit Scoring

Credit scores are traditionally based on previous banking history and behavior. But for the 1.7B unbanked people around the word, providing them a credit score was impossible. This forced them to utilize lending systems that charged absurd interest rates or overuse collateral on small loans.

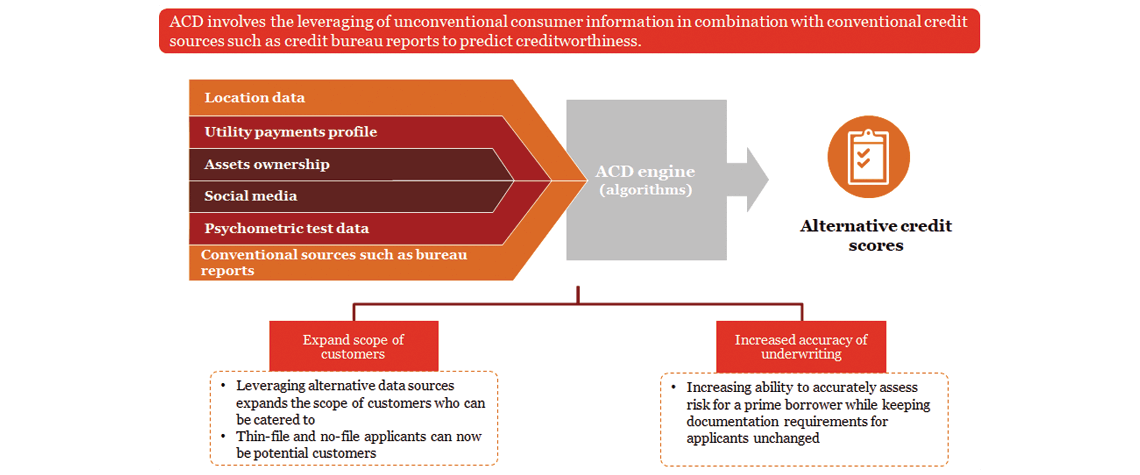

Alternative credit scoring or decisioning (ACD) uses other information to assess someone's credit worthiness.

In areas like South East Asia, India, and Mexico where internet penetration is high, many of these systems rely on a wide range of data taken from mobile devices. The actual 'recipe' used to determine someone's credit score is different for each company.

The success of alternative lending firms largely depends on the identification of the right borrower to lend to at the right time and the right place. Therefore, it is crucial that the chosen non-traditional data helps verify the identity of an individual and provides futuristic insights into behavior, particularly in relation to the likelihood and ability of repayment.

This industry powers the large P2P lending industry in emerging countries. It will also play a large role in the future of the 'Buy Now, Pay Later' market which has exploded over the pandemic and is projected to process $680B worth of transactions in 2025.

Many BNPL apps like Affirm, Klarna, Afterpay etc. don't do hard credit checks on their users. But as ACD companies continue to grow and BNPL apps face scrutiny from regulators, the two might be key players in the future of ecommerce in emerging markets, creating a smooth way for consumers to pay in installments without a credit card or prior credit history.

Predictions for the future

DeFi loan and insurance systems will take the emerging world by storm. Shifting power away from financial institutions.

Strict regulation around lending like those from the CBRC in China will follow across emerging markets, knocking out a number of smaller players and providing more market share to the leading P2P lending platforms.

Alternative credit scoring will be the future of embedded finance. Companies like Grab, Shopify, and Jio who have large ecosystems will develop their own alternative credit scoring algorithms using proprietary data. Larger institutions and payment services like Paypal will integrate existing ACD players in their core offerings to better access the underbanked population.

Big central banks in emerging markets will start to bleed market share to tech and ecommerce companies that start to 'debundle' and 'rebundle' the financial stack, starting from lending and payments.

Opportunities

Investigate and make bets on blockchain platforms and crypto currency laying the foundation for a booming DeFi ecosystem in South East Asia

Think about the unbanked and underbanked people in your region, if they have credit - what services would they want access too. How would they do it? Most developed countries don't think about targeting underserved populations. Creating a gap for companies like Square who struck gold with CashApp by targeting people who didn't have access to bank accounts.

Look at trends like Social Commerce in China that have spread outwards towards the rest of SEA. Many new unicorns were minted by focusing on underserved populations. China was the first large country in the region to have high rates of mobile penetration. Most regions will follow it.

Conclusion

The financial future of emerging markets will be based in fintech. DeFi and Alternative Credit Scoring are laying the foundation for 1.7B people to participate in the global financial economy. The unlocking of credit for the bottom of the pyramid will also create a boom in the economies of emerging markets.

If you liked this article, please consider giving it a “❤️” on Substack or sharing it with friends using the button below!