The Top 6 Developing Countries You Should Be Watching

By 2050 China and India will be the largest and second largest economy in the world. Indonesia, Brazil, and Mexico will be the fourth, fifth, and seventh respectively. We outline why.

By 2050 China and India will be the largest and second largest economy in the world. Indonesia, Brazil, and Mexico will be the fourth, fifth, and seventh respectively. If you don’t understand what’s causing those shifts, you’re missing out on the largest investment opportunity of our time.

More than 80% of the world’s working-age citizens live in developing or ‘emerging/frontier’ countries.

These are people like Sangita, a 27 year old homemaker in rural India who racked up over a million TikTok followers. Or Olugbenga Agboola, the Founder & CEO of Flutterwave - a startup in Nigeria that just raised $35M and has partnerships with China’s top digital wallets.

The lifestyles of people in these countries are very different from the World Vision ads that we grew up with. Yes, many of them are below the poverty line. Yes, a good portion of them don’t have access to clean water or consistent electricity throughout the day. But, thanks to rapid internet penetration over the past few years, almost all of them have access to a smartphone and mobile internet, where they now watch YouTube videos, start TikTok accounts, and make purchases online. This has led to a new rise of consumerism and innovation that is shifting the global economic balance.

A rural Indian woman who used to post over a dozen videos on video-sharing app TikTok makes a video on her miniature cooking with her daughter on July 1. | REUTERS

Developing economies became the main driver of global growth at the beginning of 2010 with improvements in technology and infrastructure. Population growth, mass urbanization and rising incomes will continue to propel these countries to the top of the economic and political stage. China was the first country to do this and there are many more that are following in its footsteps.

How to find the countries with the most growth

To find countries to invest in, you have to narrow down the list into ones that are steadily on their way to growth or making investments that you think will pan out in the future.

"We have 30% of our money in emerging market equities, and 0 in the US market. Within the equities landscape, emerging market equities are the place to be because of the cheapness and growth...but the most important part is getting the country right" - Arjun Divecha

What is the difference between a frontier and an emerging markets

Within developing countries there are two main distinctions: Emerging markets and Frontier markets.

Frontier markets are countries that have higher risk due to political instability, a lack of regulation, large currency fluctuations, and subpar financial reporting. These markets are typically harder to invest in but can provide larger returns.

Emerging markets are countries that don't have the same economic strength or stabilities as the US but are in the process of getting there quickly. They often have a stable government, large young population, and have been making strong investments into their infrastructure and citizens. These are also often easier to invest in (scroll to the bottom to see how you, as a retail investor, can invest in these countries).

What are the main countries that you should be looking at?

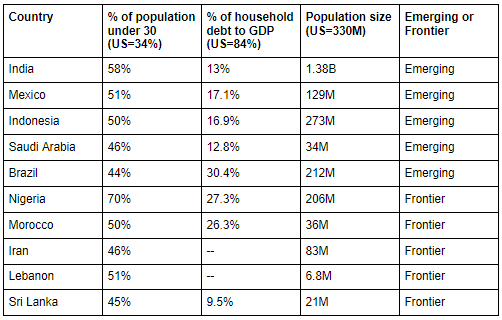

To help narrow down the list of countries worth looking into, I’ve assembled a simple framework that relies on debt and demographics. Countries with low household debt to GDP have the ability to deploy credit, increasing spending and productivity. Countries with a high percentage of their population under 30 will continue to have a large workforce over the coming years to utilize this credit and grow the economy*.

Once you remove countries with high debt or an older population, you’re left with some of the countries below. I’ve categorized them as Emerging or Frontier to give you a better idea of their current state.

*There are many other factors that you can incorporate such as government stability, education level, reserve currency, or their ability to recover from economic disasters like COVID19. But for the purpose of this article we’ll keep it simple. We’ll dive into some of these other factors in future articles.

This information was gathered from census data, populationpyramids.org, and https://tradingeconomics.com/country-list/households-debt-to-gdp.

What are the most exciting things happening in those countries?

The key to picking a country with strong growth potential is to have a keen understanding of how they are growing. Changes like large investments in infrastructure, the loosening of regulations, or big changes in politics can give you a sense of how countries are planning to use the credit to grow their overall economies. Some of the most exciting changes that I’ve been investigating are below (click to expand)

“Because credit creates both spending power and debt, whether or not more credit is desirable depends on whether the borrowed money is used productively enough to generate sufficient income to service the debt.”

― Ray Dalio, Big Debt Crises

Nigeria (Frontier Market)

Quick Summary: Nigeria has a very young population, increasing smartphone penetration, and a focused regulatory push on cashless payments and financial innovation. It is quickly becoming the hub for fintech innovation pushing the boundaries of how we pay for goods and services across the world. The risks are a lack of government transparency, poor infrastructure, and the strength of their currency (the naira).

To Read More: McKinsey has published an excellent report on Nigeria’s Fintech Ecosystem here. My favorite publication to stay on top of high level news in Africa is Quartz Africa or African Business which covers a number of specific regions within Africa.

Morocco (Frontier Market)

Quick Summary: Morocco’s political stability, geographical location, and efforts to build a robust infrastructure are leading to its rise as a regional manufacturing and export base. Reports by the world bank predict that Morocco’s per capita GDP (in purchasing power parity) could reach almost 45 percent of that of a southern European country such as Spain or France by 2040. With strong investments into its people through education and quality of life, Morocco could become a power player in North Africa. The risks are in how well it can recover from COVID19 and if it can reduce the wealth and low levels of education in its younger population.

To Read More: The World Bank Group published an excellent report on Morocco 2040 here that details how it can address its weaknesses. To stay on top of news coming out from Morocco including new partnerships with China and its COVID19 recovers, I recommend Moroccan World News.

Iran (Frontier Market)

Quick Summary: Iran has considerable potential with a large educated young population, a location that provides strong trade potential with Europe and Asia, and an economy that is becoming diversified away from oil. However, sanctions from the United States and its partnership with China are key factors in its growth potential. Both are currently hindering it but could result in large benefits towards Iran’s economy if the political attitude towards Iran changes.

To Read More: The IMF (International Monetary Fund) has a report on the economic outlook of Iran here. Foreign Policy has a few good articles outlining Iran’s relationships with China and its role in China’s larger economic strategy here and here.

India (Emerging Market)

Quick Summary: India has heavily invested into its internal infrastructure providing mobile internet access to 500M+ new Indians over the past few years. They also have the largest group of young people (600M) in the world and have started implementing stronger policies around foriegn investment and looser financial regulation with the goal of creating its own world leading companies. It’s risks are high levels of government red tape, poverty levels, and poor infrastructure. This is a market that I am very bullish on.

To Read More: The Rise of the Internet contains everything you need to know about India’s internet infrastructure and 5 Industries That Will Create the Next Generation of Global Giants in India will give you a quick overview over a few key sectors within the Indian economy.

Indonesia (Emerging Market)

Quick Summary: As the largest economy in Southeast Asia, Indonesia will have a critical role to play as China and India grow their economies. They have reduced their poverty rate by half to 9.98% since 1999 and are making strong investment into their human capital. They also have been experiencing an influx in venture capital funding and have their own unicorns like Gojek, Tokepedia, Traveloka. Risks are mainly around its dependency on China for exports and level of strong infrastructure that the country currently has.

To Read More: The World Bank has a great report on Indonesia’s economy here. You can already read about the innovation economy that is fueling their technology growth here.

Saudi Arabia (Emerging Market)

Quick Summary: Already considered as the largest economy in the Middle East, Saudi Arabia has been focused on diversifying its economy away from oil. They have been investing heavily in tourism, renewable energy, and manufacturing - all of which has been accelerated by the recent drop in oil prices. Risks include restrictions on foreign investment, economic transparency, and how successfully Saudi Arabia will be able to continue privatizing its state assets to free up cash following the scaled back IPO of Saudi Aramco in 2019.

To Read More: Control Risk has a good overview of Saudi Arabia’s economy and diversification efforts here. Arab News is a good publication to keep a pulse on what is happening in Saudi Arabia, link here.

How do I invest in these countries?

As a regular retail investor there are a few different ways to invest which include large ETF’s focused on a number of regions, country-specific ETF’s that focus on individual countries, or ADR’s of prominent companies within countries you might be interested in. You can find a list of ETF’s or ADR’s to invest in here.

Conclusion

Over the next 20 years the growth of emerging and frontier markets will far exceed that of developed ones. In order to take full advantage of that, you will need to understand what the major developments are in the developing world, what that means for economic growth, and how you as a retail investor can take advantage of that.

Some of my favorite publications to follow are The Economist, Quartz Africa, and the Tech News Asia. Or you can subscribe to our monthly round up below. We’ll send you the best articles and research from around the web on emerging markets in addition to our own takes on what's going on in the world.

What are your thoughts on Bangladesh as an Emerging or Frontier economy?